YSR Bima Scheme Eligibility, Benefits Amount and Status at official website at https://ysrbima.ap.gov.in/

YSR Bima

The government of Andhra Pradesh has launched a new insurance program called the YSR Bheema scheme. This article will explain what the YSR Bheema scheme is all about, why it was introduced, its advantages, features, who can apply for it, and how to apply. Similar to the YSR Housing Scheme for housing, the YSR Bheema Scheme is for providing life insurance to family members. Let’s learn more about this initiative together.

Under the YSR Bheema Scheme, eligible beneficiaries can avail of life insurance coverage of a specified amount. This ensures that the family left behind after the insured’s demise will receive financial assistance to cope with the loss and manage their daily expenses.

YSR Bheema

One of the notable features of the YSR Bheema Scheme is its affordability and accessibility. The premiums for the insurance policy are relatively low, making it feasible for low-income families to participate in the program. The enrollment process is straightforward, and interested individuals can apply easily through designated channels set up by the government.

The scheme covers various occupational groups, including unorganized workers, small and marginal farmers, artisans, and other vulnerable sections of society. By providing this social security net, the YSR Bheema Scheme aims to alleviate the financial burden on families during challenging times.

The YSR Bheema Scheme is an essential step towards ensuring the welfare and protection of families in Andhra Pradesh. It reflects the government’s commitment to supporting its citizens and fostering financial inclusivity. The scheme brings a sense of security to beneficiaries, knowing that their families will have some financial assistance to rely on when they need it the most.

ysrbima.ap.gov.in

| Scheme Name | YSR Bima Scheme |

| Introduced By | Government of Andhra Pradesh, India |

| Purpose | Provide life insurance coverage to low-income families |

| Coverage Amount | Specified amount of life insurance coverage |

| Beneficiaries | Low-income families, including unorganized workers, farmers, artisans, and vulnerable sections |

| Official website | https://ysrbima.ap.gov.in/ |

YSR Bheema Scheme Benefits

- For individuals aged between 18 and 50, there is insurance coverage of Rs 5 lakh for unnatural death and complete and permanent disability.

- Between the ages of 51 and 70, the coverage is Rs 3 lakh for unnatural death and complete and permanent disability.

- Additionally, for those aged between 18 and 50, there are insurance benefits of Rs 2 lakh in the event of natural death.

- In case of a permanent partial disability caused by an accident between the ages of 18 and 70, the insurance benefits amount to Rs 1.5 lakh.

YSR Bheema Scheme Active and Inactive Accounts

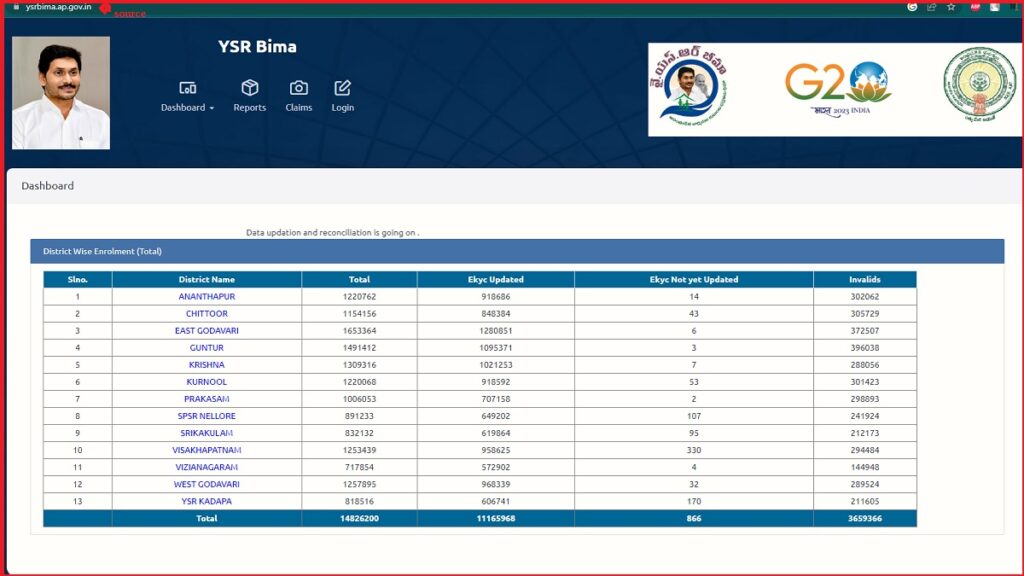

- To access the details of active and inactive accounts under the YSR Bheema scheme.

- Click on the “YSR Bhima Active & Inactive Accounts Dashboard”.

- Once you click the link, a new page will appear on your computer screen.

- On this page, you will see a breakdown of the number of active and inactive accounts for each district.

- To view the report for a specific district, you need to select the district of your interest.

- After selecting the district, a new window will open, presenting the relevant information for your review.