PM Jan Dhan Yojana Balance Check, प्रधानमंत्री जन-धन योजना लिस्ट 2023 Apply Online at Pmjdy.gov.in

Pradhan Mantri Jan Dhan Yojana

The Pradhan Mantri Jan-Dhan Yojana (PMJDY) is a nationwide initiative that promotes financial inclusion and aims to ensure universal access to essential financial services. These services include banking and savings accounts, deposit facilities, remittance options, credit access, insurance coverage, and pension benefits, among others. The PMJDY program strives to provide every individual with the means to participate in the formal financial system and enjoy the benefits it offers.

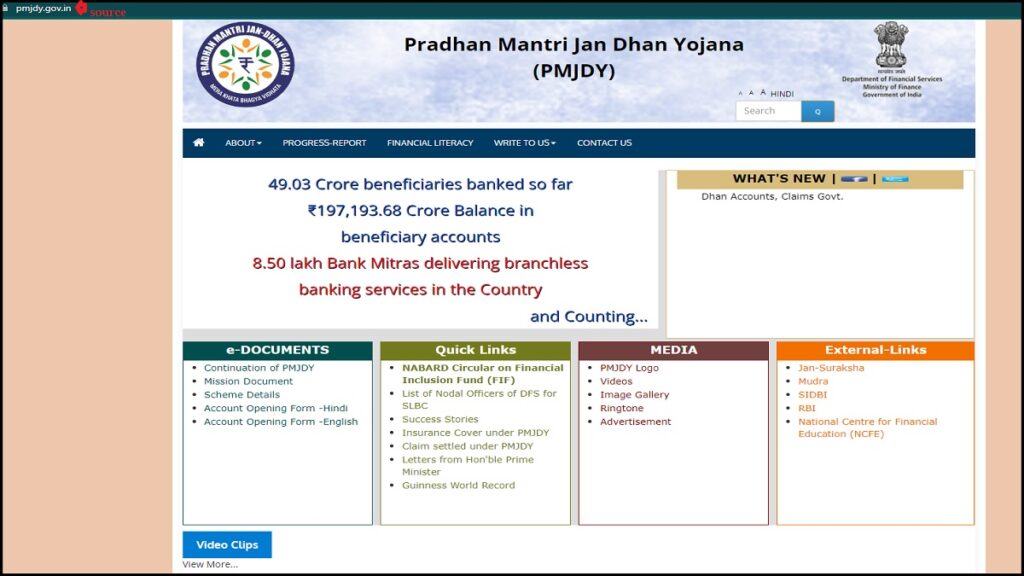

To date, a staggering 49.03 crore beneficiaries have successfully deposited funds in various banks across the country. The total amount of funds deposited by these beneficiaries stands at a remarkable ₹197,193.68 crores.

The Pradhan Mantri Jan-Dhan Yojana is a transformative initiative that aims to provide financial inclusion to all citizens of India. By opening a PMJDY account, individuals can access a range of banking services, avail themselves of government schemes, and enhance their financial security. We will guide you in applying and opening an account under PMJDY, ensuring that you become a part of this nationwide mission for financial inclusion.

PM Jan Dhan Yojana

| Scheme Name | Jan Dhan Yojana |

| Launched by | Government of India |

| Eligibility | Residents |

| Benefit | Financial benefits |

| Application | Online/ Offline |

| Official website | https://pmjdy.gov.in/ |

What is PM Jan-Dhan Yojana?

PMJDY is a national mission that seeks to ensure universal access to financial services for all individuals. The program aims to bring the unbanked population into the formal banking system and provide them with a range of financial services. These services include opening bank accounts, issuing debit cards, enabling digital payments, providing access to credit facilities, insurance coverage, and pension schemes.

Benefits of PM Jan-Dhan Yojana

- Financial Inclusion: PMJDY promotes financial inclusion by offering basic banking services to those who have never had access to formal banking facilities.

- No Minimum Balance Requirement: Accounts opened under PMJDY have no minimum balance requirement, making them accessible to individuals from all economic backgrounds.

- Rupay Debit Card: Account holders receive a Rupay debit card that allows them to make cashless transactions, withdraw money from ATMs, and make online payments.

- Overdraft Facility: PMJDY accounts are eligible for an overdraft facility of up to Rs. 10,000, providing a financial safety net to account holders during emergencies.

- Accidental Insurance Cover: Account holders are provided with an accidental insurance cover of Rs. 2 lakh to ensure their financial security.

- Access to Government Schemes: PMJDY account holders can easily access various government welfare schemes and subsidies directly in their bank accounts.

Required Documents

- Aadhaar card

- Proof of Identity (Voter ID Card, Driving License, PAN Card, Passport and NREGA Card)

- Identity card with photograph of the applicant issued by Central

- Letter issued by a Gazetted Officer with duly attested photograph of the said person

How to Apply and Open an Account under PMJDY ?

- Visit a Bank or Business Correspondent (BC): Locate a nearby bank branch or BC authorized to open PMJDY accounts. Ensure you carry the required documents for account opening.

- Fill the Account Opening Form: Obtain the PMJDY account opening form from the bank or BC. Fill in the necessary details such as name, address, contact information, and nominee details.

- Provide KYC Documents: Submit the required Know Your Customer (KYC) documents, which may include Aadhaar card, Voter ID card, PAN card, or any other officially accepted identification proof.

- Biometric Authentication: Under PMJDY, biometric authentication is crucial. Your fingerprints and photograph will be taken for verification purposes.

- Receive the Welcome Kit: Once your application is processed and approved, you will receive a welcome kit containing your account details, Rupay debit card, and other relevant information.

- Activate Your Account: Visit the bank or ATM to activate your account using the provided Rupay debit card and PIN. Alternatively, you can activate it through internet banking or mobile banking services.

How to Check PM Jan Dhan Balance Online ?

- First, visit the official website of the Public Financial Management System (PFMS) i.e., https://pfms.nic.in/NewDefaultHome.aspx#

- On the home page, locate the option labeled “Know Your Payments” and click on it.

- A new page will appear before you.

- On this page, provide your bank account number and select the corresponding bank from the dropdown menu. Additionally, enter the captcha code displayed on the screen.

- After successfully entering the captcha code, look for the option “Send OTP on registered Mobile No.” and click on it. A One-Time Password (OTP) will be sent to your registered mobile number.

- Retrieve the OTP from your mobile and enter it in the designated field. Once entered, submit the form.

- The PM Jan Dhan Yojana Balance will appear on your screen.